Being weekend, we may not see big price swings in major crypto’s. However, with more exchanges and Wallets extending support for the upcoming Bitcoin Cash hard Fork, we may see higher price in BCH/USD pair this week.

BTC/USD

At the time of writing this article, Bitcoin is trading around $6335, a slight retracement from overnight highs of $6375 Until the price stays above $6250, Next trading range will be $6250-$6450 area. If there is a sudden price breakout above $6450 and stays above it, we can see $6600 price levels.

Daily volumes are holding the levels of $4B, which is slightly positive for the price to move higher.

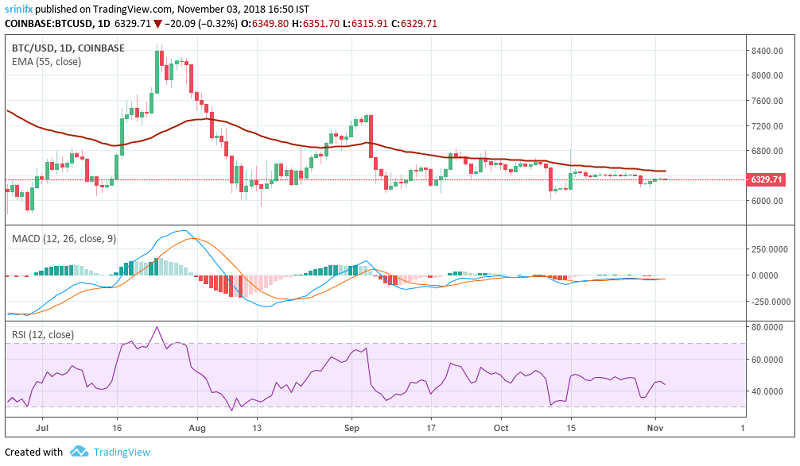

Bitcoin [BTC] Technical Analysis

Based on the Bitcoin BTC/USD daily chart, the price is still below the critical level of 55Day EMA, MACD is just below the Signal Line and RSI is showing slight strength at 44 Levels. This indicates a Neutral to slightly positive bias; As Price is far below from 200Day EMA indicating bearish trend intact.

Data as per TradingView

Bitcoin Prediction (Short to Medium term)

As long as the Bitcoin Price holds $6250 level and breaks above $6450, we can expect a quick rally towards $6600 Area or else consolidation in the trading ranges $6250-$6400 Area.

XRP/USD

At the time of writing this article, Ripple XRP is trading at $0.4575. As stated in my earlier article, there was a sudden price breakout above $0.45 and XRP price entered Next trading range of $0.45-$0.4750 area. Being weekend we may not see big movements out of range. Next support level would be $0.45 where we can see some buying and next minor resistance level to watch is $0.4750 where we can expect some selling.

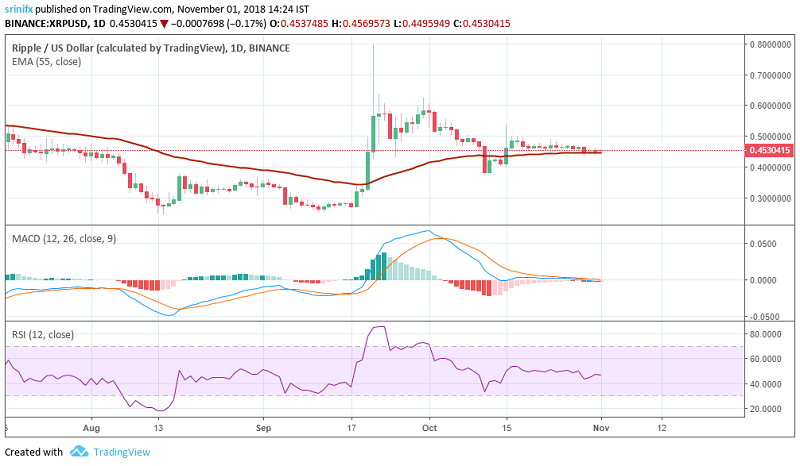

Ripple [XRP] Technical Analysis

Based on the Ripple XRP/USD daily chart, price managed to stay above an important level of 50Day EMA, MACD is straightening just above the Signal Line and RSI is now at 48, steadily raising towards 50Level. This indicates slightly positive bias, Daily volumes are holding the levels of $350m which supports the above trading bias.

Data as per TradingView

Ripple Prediction (Short to Medium term)

As long as the Ripple Price holds $0.4550 and breaks above $0.4750, we can expect a quick rally towards $0.49 to $0.52 Area.

BCH/USD

Soon after the tweet from “Binance” exchange extending support for the upcoming Bitcoin Cash Hard Fork, Buyers pushed the price above $450 with an increase in volumes. At the time of writing this article, Bitcoin Cash BCH/USD is trading at $472, a slight increase from overnight gains of $460 levels. As long as the price stays above $450, Next trading range will be $460-$485 area. If there is a sudden price breakout above $485 and stays above it, we can see $510 price levels easily

Daily volumes are holding the levels $500m and increasing, which is a positive sign for the price to move higher.

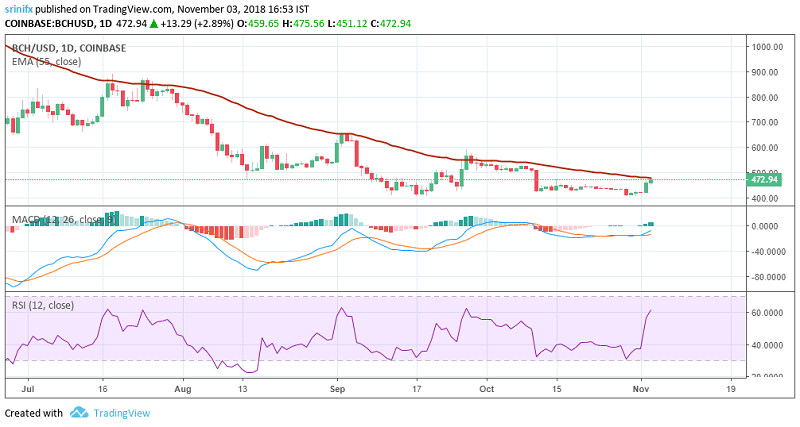

Bitcoin Cash [BCH] Technical Analysis

Based on the Bitcoin Cash BCH/USD daily chart, the price is just below the critical level of 55Day EMA, Even though MACD is below the Signal Line it is showing strength along with (MACD histogram in green) and RSI is showing signs of bullishness and is at 60 levels. This indicates a positive to a bullish bias.

Data as per TradingView

Bitcoin Cash Prediction (Short to Medium term)

As long as the Bitcoin Cash Price holds $450 and breaks above $485, we can expect a quick rally towards $510 Area or else consolidations in the trading range $460-$485 Area.

Credits:- Srinivas Podila

This article should not be considered as an investment advice. Please conduct your own research before investing in any cryptocurrency.