Ethereum [ETH] the 2nd largest cryptocurrency by market capitalization now seems to be in a bullish move. Ethereum is trading at $211.82 with an increase of 6.96% and the market capitalization at the time of writing this post is $21,615,538,104 USD as per Coinmarketcap. The 24h high for ETH is 215.47 and 24h low for ETH is 195.15.

Ethereum Price Prediction and Technical Analysis

Here we will do the analysis based on 1-day and 1h price forecast. So let’s start the analysis based on SMA, EMA, MACD Level, RSI, and other technicals.

1-day Price Forecast

Although Ethereum is up 6.96 percent now it is still below its 20, 30, 50 days EMA and SMA. The 10-day Exponential Moving Average is 211.63 and 10-day Simple Moving Average is 204.32. Both the EMA (10) and SMA (10) is indicating a buy signal.

Data as per Binance

But while looking at the EMA (20, 30, 50) and SMA (20, 30, 50) all of these EMA and SMA are indicating towards selling. Also, let’s have a look at the Oscillators the Relative Strength Index (14) is 39.87 which is in the Neutral zone and the MACD Level (12, 27) is -24.42 indicating a buying signal.

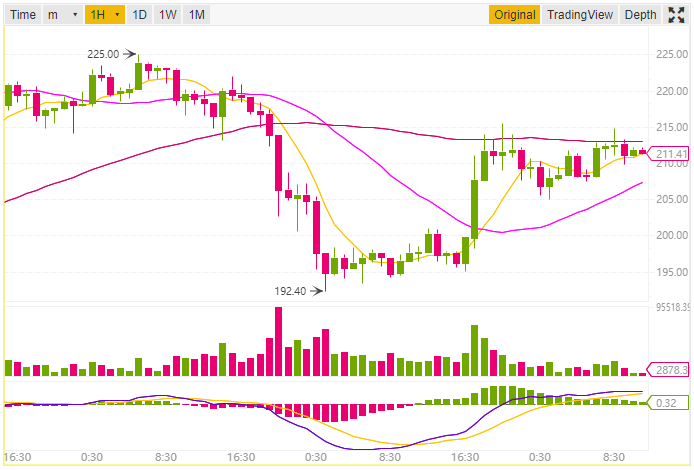

1-h Price Forecast

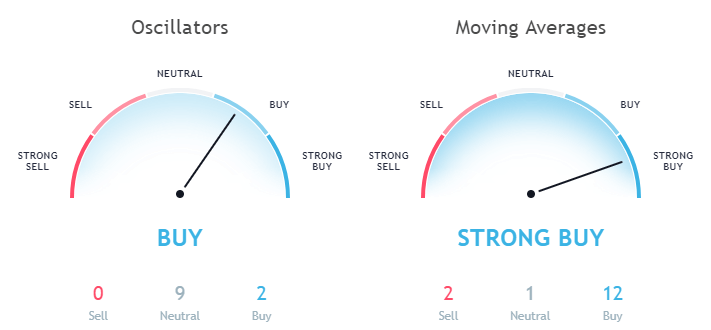

In the 1h price forecast, Ethereum seems to be in a massive bullish move. The Exponential Moving Average (10) is 210.80 while Simple Moving Average (10) is 210.82 both of them depicting buying. Not only this all other EMA (20, 30, 50) and SMA (20, 30, 50) is indicating buying.

Data as per TradingView

Now let’s have a look at the oscillators, the Relative Strength Index (14) is 57.81 and is currently in the Neutral Zone. The MACD Level (12, 27) is 1.81 indicating buy signal. The Momentum (10) which is 3.65 depicting towards buying.

This article should not be considered as an investment advice. Please conduct your own research before investing in any cryptocurrency.