In order to be a successful trader, it is essential to be able to profit not only from uptrends but also from downtrends. Over the past several months, the crypto markets have been downtrend with very few extensive money-making opportunities on the upside.

The causes of the downtrend appear to be various and interlinked with traditional markets, mainly due to central banks around the world increasing interest rates and stopping large-scale asset purchases, also known as quantitative easing. This has reduced the appetite for risk assets, such as blockchain and DeFi-related cryptocurrencies.

Coinrule automated trading bots and shorting

As a trader and investor, shorting can be challenging from an emotional and psychological perspective, with the possibility of being bearish on coins in the short term that you are planning to own for the long term.

This conflicting viewpoint results in money-making opportunities being missed due to denial and the endowment effect – where individuals are more likely to keep an asset they own than purchase the asset if they did not already own it.

Removing this emotional attachment can be achieved by using Coinrule’s automated trading bots, where all your trades are automated, allowing you to earn passive income with little involvement or intervention.

About short selling

Short selling is the process of selling a cryptocurrency and buying it back at a lower price.

This can allow you to profit in two ways. The first way is to profit by buying back the coins that you sold and keeping the remainder in cash. The second way is to accumulate more crypto by using the profit earned to buy more of that coin.

The two strategies depend on your risk tolerance, with the first option being more risk-averse by keeping the profit in cash, and the second being riskier with the possibility of the coin you purchase continuing to lose value.

Shorting bots can allow you to remove the emotional element of trading to maximize your profits. Using indicators, such as moving averages, increases the probability of success with trades being executed when the price falls below a long-term moving average.

Long-term moving averages are often key supports and are retested. If the price fails to hold above the moving average, there will often be a large decline before the price finds another support – leading to a perfect opportunity to short.

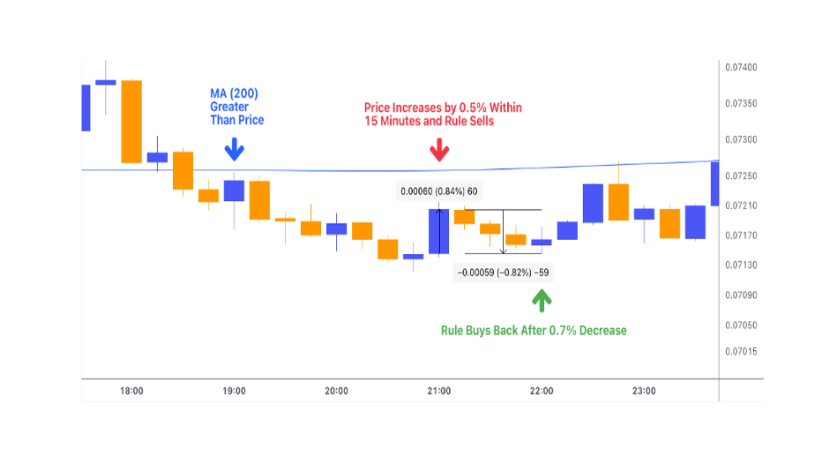

Below is an example of a setup you could use for an automated trading bot.

What is optimized short scalping?

Optimized short scalping is a perfect strategy to scalp coins that are in a downtrend. The example below features Tron.

To open the trade, the bot will sell when the MA (200) is greater than the price, with the MA (200) in the 15-minute timeframe. The coin will also need to increase by 0.5% within 15 minutes.

As the price is below the MA (200), it is probable that the coin is now in a downtrend, and any price increases should be seen as a take-profit opportunity.

To close the trade, the bot will buy back 100% of the amount sold once the price has decreased by 0.7% from the buying price, resulting in a profit of 0.7%. This strategy also utilizes the “Any Time” Operator that allows consecutive sell orders to open multiple trades simultaneously.

This strategy is perfect for traders when they are bearish on the market and want to capitalize on the downside.

Keep updated

Regarding cryptocurrency trading, bots are one of the most suitable options for making better selections and avoiding costly mistakes. However, it is a domain in constant development. So, keep updated with its expansions and be the first to find out the news.