Bitcoin bull Tim Draper has shared his opinion on cryptocurrencies. He said that the market capitalization of cryptocurrencies will hit $80 Trillion in 15 Years i.e. four hundred times of the current one.

While Mike Novogratz says the Cryptocurrency market has found a bottom. As you see the market has seen steady declines for the past nine months. Almost all the altcoins are decline by about 80 percent of their all-time high.

So let’s have a look at the technical price analysis of Bitcoin, Ethereum, Ripple, and Litecoin. All the views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Koinalert.

Bitcoin Price Analysis BTC/USD

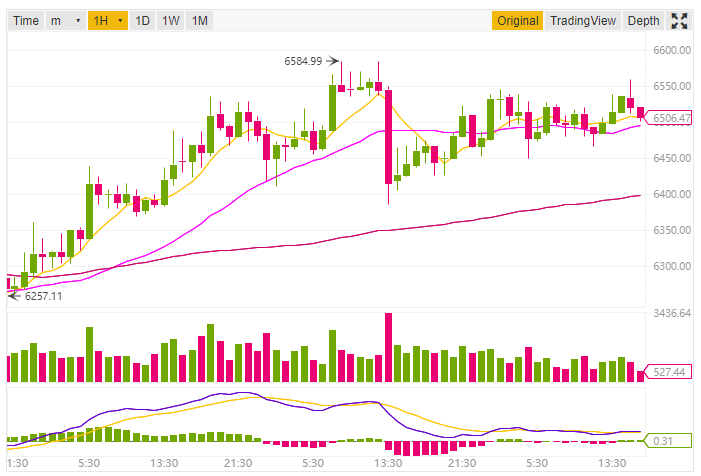

Let’s have a look at the Bitcoin price analysis whether the bull woke up or still sleeping. Bitcoin the No. 1 cryptocurrency by market capitalization is currently trading at $6,527.93 with a market capitalization of $112,729,303,964. Data is as per the Coinmarketcap at the time of writing this post.

Data as per Binance

As you see at the moving averages the Exponential Moving Average (10, 20, 30, 50) is 6493.7, 6585.2, 6643.9 and 6734.0 respectively. The recommended action of EMA (10) is buying, while the EMA (20, 30, 50) is selling.

Data as per TradingView

Also looking at the Oscillators the Relative Strength Index (14) is 46.9 which is in the neutral zone. The MACD level (12, 27) is -106.7 recommending sell.

Ethereum Price Analysis ETH/USD

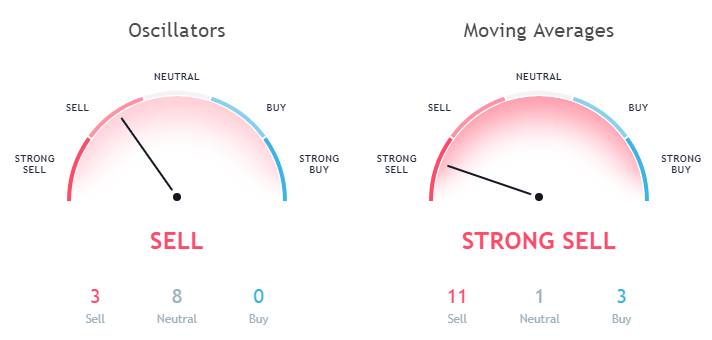

While looking at the Ethereum price analysis it is currently trading at $216.89 having a market capitalization of $22,116,272,710 as per Coinmarketcap. The 10-day EMA and SMA for Ethereum are 214.25 and 204.04 respectively. Here both EMA (10) and SMA (10) is recommending buying.

Data as per TradingView

While rest all the EMA (10, 20, 30, 50) and SMA (10, 20, 30, 50) is recommending selling. Let’s have a look at the Oscillators, the MACD Level is -30.48 indicating buy signal. The Relative Strength Index (14) is 38.05 which is in the neutral zone.

Ripple Price Analysis XRP/USD

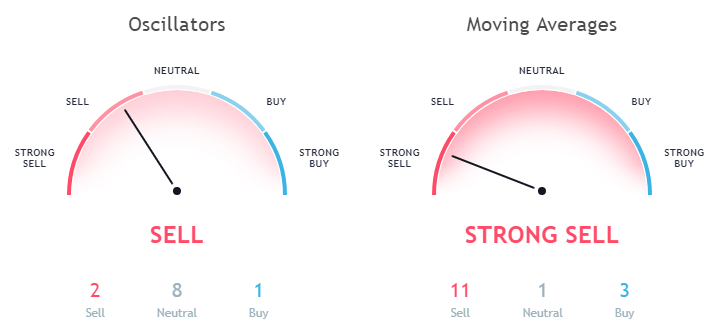

Ripple XRP being the 3rd largest cryptocurrency by market capitalization $11,144,651,700 is trading at $0.279953. Ripple is trying its level best to sustain above $0.27

The 10-day Simple Moving Average is 0.27805 which is recommending a buy signal. The 10-day EMA is 0.28309 indicating selling. Ripple has not yet broken the 50-day EMA 0.34134 lets now have a look at the oscillators.

Data as per TradingView

After looking at the oscillators the MACD Level (12, 27) is -0.01978 indicating selling. While the Relative Strength Index (14) is 40.70655 which is in the neutral zone.

Litecoin Price Analysis LTC/USD

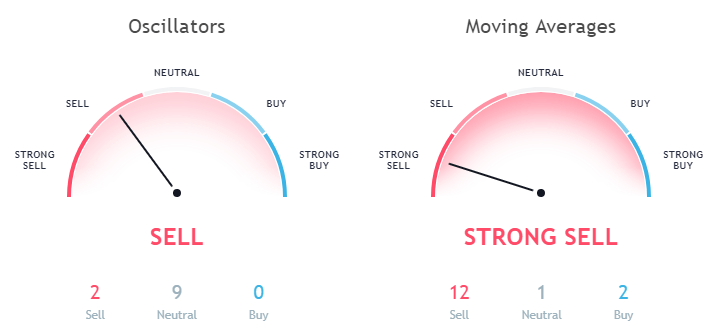

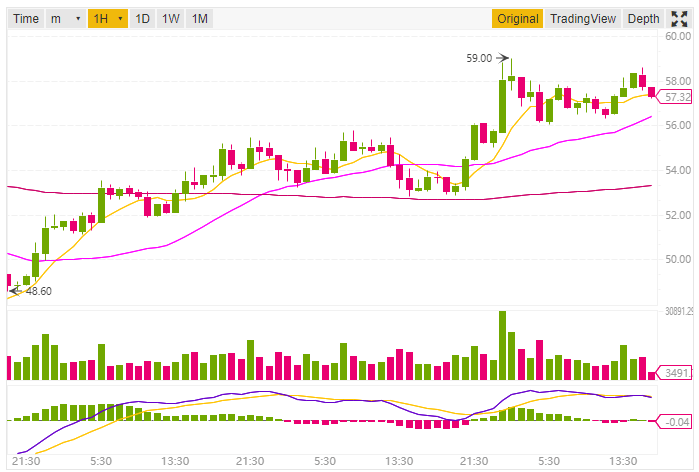

Litecoin being the 7th largest cryptocurrency by market capitalization is trading at $57.78 at the time of writing this article. The current market capitalization of LTC/USD is $3,368,799,044 as per Coinmarketcap.

Data as per Binance

Litecoin has broken the 10-day and 20-day EMA having values 55.989 and 57.518 respectively. It has not yet broken the 50-day EMA of 63.821

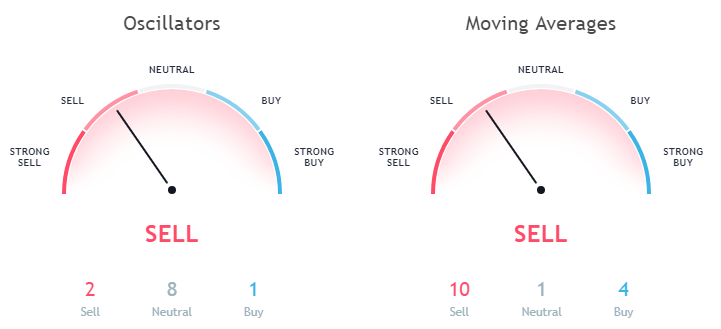

Data as per TradingView

While looking at the Oscillators the Relative Strength Index (14) is 48.159 which is in the neutral phase. The MACD level (12, 27) is -2.230 indicating a buy signal.

This article should not be considered as an investment advice. Please conduct your own research before investing in any cryptocurrency.