Ripple XRP is the 3rd largest cryptocurrencies by Market Capitalization is currently trading at $0.565127 USD (+7.36%) according to CoinMarketCap at the time of writing this post. The 24h High for this cryptocurrency is $0.58000 and 24h Low is $0.51931 (As per Binance XRP/USDT pair). The market capitalization for Ripple XRP while writing this post is $22,532,127,336 USD (CoinMarketCap).

As you know Ripple is going to host an event at San Francisco, CA on October 1-2, 2018. As per the official website “Swell, hosted by Ripple, connects the world’s leading experts on policy, payments, and technology for the most provocative dialogue in global payments today.”

This Swell by Ripple might decide the next bull run as the keynote speaker here is President Bill Clinton.

Also, one day ago Ripple (XRP) has introduced a social impact program by the corporate, aimed at supporting organizations that help increase financial literacy amongst people. “Ripple for Good“, as the program is being called, will support these mission-driven initiatives, groups, and organizations.

Ripple Price Prediction and Technical Analysis

We will do the analysis in two parts, the first will be based on 1-day price forecast while the other will be 1h price forecast.

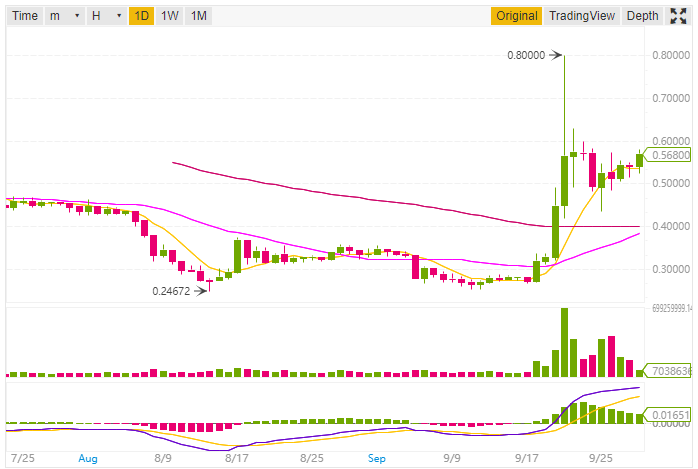

1-day Price Forecast

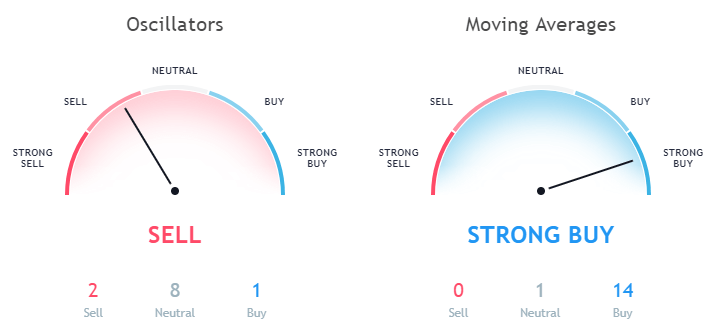

We will do the analysis based on Moving Averages and Oscillators. So let’s start with the moving averages the Exponential Moving Average (10) for XRP is 0.50867 while the Simple Moving Average (10) is 0.53507. Here both these moving averages are indicating a buy signal. Not only this all other moving averages like EMA (20, 30, 50, 100, 200) and SMA (20, 30, 50, 100, 200) is in the buy zone.

Data as per Binance

Also, the Volume Weighted Moving Average (20) which is 0.48974 is in the buy zone. The Hull Moving Average (9) is 0.54757 which is also indicating a buy signal. Here you can notice that all the moving averages are indicating a buy signal. It seems next bull run will be there before the Swell Event by Ripple.

Data as per TradingView

While looking at the Oscillators the Relative Strength Index (14) is 71.72359 which is in the Sell Zone and the MACD Level (12, 27) is 0.06470 and recommending buying. Momentum (10) is also in the buying zone having a value of 0.25149.

The Bull Bear Power for XRP is 0.13242 which is in the Neutral zone.

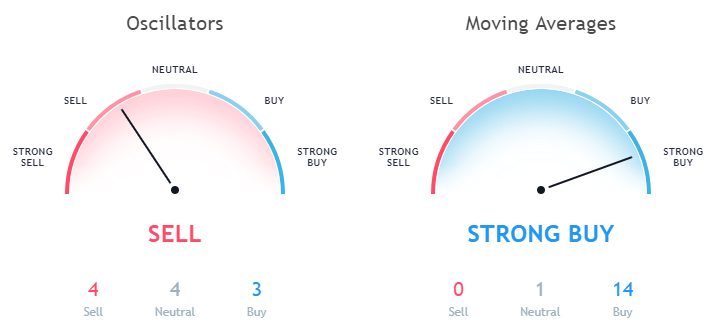

1h Price Forecast

Now let’s discuss the price forecast based on 1-hour price graph. While looking at the Moving Averages of 1h price graph the Exponential Moving Average (10) is 0.55221 and Simple Moving Average (10) is 0.54420. Here both the EMA (10) and SMA (10) is indicating a buy signal.

Not only this all other EMA (20, 30, 50, 100, 200) and SMA (20, 30, 50, 100, 200) is indicating towards a massive buy signal. The only moving average which is in the neutral zone is Ichimoku Cloud Base Line (9, 26, 52, 26) having a value of 0.55801.

Data as per TradingView

Also, while looking at the Oscillators the Relative Strength Index (14) in the 1h forecast is 79.17233 which is in the sell zone. The MACD level (12, 27) is 0.00794 indicating a buy signal. The Awesome Oscillator having a value of 0.01573 is in the buy zone.

This article should not be considered as an investment advice. Please conduct your own research before investing in any cryptocurrency.